Lazy Money Mind to Loving Money Clarity

Organizing my money, my mindset, my action plan I completed in a month.

As I was about to write this article, I came across a quote that said, “Who is the richest person in the world?” and said, “The person who has enough.”

I thought it was the perfect intro to this article because I intended to understand money and how to manage it, grow it and, most importantly, enjoy it.

How to understand my money?

I had first to understand my money mindset.... as well as my partners

I have never really liked the term “RICH” as they imply so much negativity around it; however, I don’t believe that if you use another word like WEALTHY which rhythms with HEALTHY, it sounds so much better.

And that’s what I want to share with you: I’ve changed my mindset to wanting to be FULLY aware of how to become more healthy with my money to feel more wealthy in all areas of my life.

As I will admit here... I was putting my head in the SAND deeply regarding my money mindset. I don’t think it’s completely unhealthy; I feel like I have avoided CARING about the health of my money. Money felt overwhelming because I never sat down to learn how to make it work.

I love the term “money is energy”, and I believe it so much now that it can feel perfect sometimes and boosts your energy, and it can feel deficient energy when things feel heavy, and the pressure is on.

I have a mixed ATTITUDE towards money inside my head. I say to myself, “You only live once”, which is a mindset I had for years working in a corporate job, and I only had to care for myself or contribute towards my rent with a partner.

I love spending money on our home, creating it into a space we love to be in. I love spending it on delicious food with friends or on date nights. I love spending it on dresses by my favourite designer, Spell, as they are an eco-aware brand that preloved clothes can be sold again, and it holds value. However, now I overthink how I could spend that money in multiple other ways and avoid indulging because I’m trying to be conservative as it’s not just me I am considering when spending. My husband's mindset has brushed off on me as that is how he operates. However, in saying that, I hear him saying buy it if that’s what you want and like.

Joint banking vs keeping things separate when in a relationship

This could be an article all on its own. Still, I will state for information purposes for you to understand that I am currently not working and have closed down my business and only operate it with ad hoc yoga events or sell pottery or my art online when my creativity is flowing. This means we have been living on one income since the beginning of 2023.

Relationships and money can always trigger a couple because two people have different methods of operating with it and different values and upbringings with how they want to spend, save and earn it. My opinion on this has always been to be more open and honest about communicating how you feel about money vs hiding it because it never gets resolved or improves. Even if it is scary to talk about money which I have felt before ... I have learnt that honesty about how I think personally is a better outcome. However, your partner decides to show up is up to them, and if that makes things worse, then there is more of an issue than money.

One Income Family

We are about to become a one-income family of 4! This hasn’t scared me because we have managed to save so much money on Phoenix by only buying the essentials and borrowing a lot of stuff secondhand. We have probably saved thousands of dollars by not buying new and using reusable nappies, as they are the most expensive items families use monthly. This is another topic I could go into detail with, but I will pause it there and would love to know in the comments if you would like to learn more about what we bought as essential items and how we saved.

Not working for the past 8 months, I have felt low about my self-esteem and not financially providing for my family. Still, those thoughts go away fast when Phoenix quickly reminds me how I am providing the energy of support that is not exchanged in a paycheck every two weeks but is valued in our home especially when Tony acknowledges all my efforts.

Learning to live with earning less to no income at all hasn’t been a shock as it started for me when I left my corporate job and have made less ever since and have built a whole lifestyle around being content and happy with not having as much income because I learnt that I don’t need much to be happy as most of my life previously was caught up in the material world. Becoming a yogi has grounded me into loving this lifestyle of less it more.

Becoming a new parent, you can get caught up with wanting new things, so my practice of less is more was put to the test, and we have managed to maintain this lifestyle still, and I am proud of this mindset.

I/We understand our money because we both share the same values on how we view money and are open to learning new ways so that it can benefit us more in the future for us all as a family and the vision we have for our life.

How to manage money?

I had first to understand where I was at with managing it by knowing my good and not-so-good habits. Secondly, I had to self-educate myself in what you would think is essential knowledge. Still, I now understand many people do not know either, so if you are like me, you need to get your learning cap on as I dive into how I love my money clarity.

KNOW YOUR HABITS

Not-so-good money habits

• Budgeting habit - I don’t follow a budget consistently

• Saving habit - I can save and reach a point or an amount and then goes on a house project or a trip

• Spending habits - I don’t look at the pricing of essential items and retain the cost to know next time I purchase them if they are more expensive bananas than last week

Good money habits

• Budgeting habit - I have a yearly spreadsheet for a budget and use it occasionally for years when I get into it and then drop it

• Saving habit - Good at setting savings goals and achieving them

• Spending habit - I am good with spending my money on quality vs quantity items now (with a focus on the environment when making purchases)

I have probably been on this journey for a few years now and have found YouTube channels to help me understand the terminology of money used today; that is SOO confusing.

• Like inflation (no clue how it was impacting my money personally until I learnt about it)

• Like my Super Fund and how it should be in a growth fund if I’m under the age of 45

• Like EFT or Index Funds or Capital Gains Tax

• Like what is an offset account for your mortgage?

NO friggin clue about what any of these things mean, but I kept hearing them being used and thinking, oh yeah, I should get on to that and NEVER bothered as my creative mind did not want to put the time or effort into it.

SELF EDUCATE

Below are recommendations from experts, as I am no money expert. I am just sharing my journey with money to help you relate to someone who has changed her money mindset and methods. How I did it so you can see it’s not impossible, and it’s a real-life example of how it’s never too late to start caring more about your money.

READ

1. BAREFOOT INVESTOR - a great way to organize and structure your money. This bucket system is how we have managed our money for years now

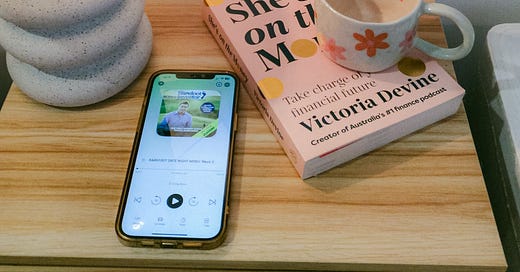

2. She’s On The Money - another excellent financial advisor for women, especially as she gets your needs. I am still finishing this book.

WATCH or LISTEN to PODCAST

The 3 MONEY MYTHS That Keep You Poor! (How To Build Wealth) | Jaspreet Singh & Jay Shetty - so many golden nuggets in this podcast

Quote: 4 Aspects of Life you need to be happy and fulfilled life are:

Physically fit - your health needs to be the priority; otherwise, no money will make you happy

Mentally fit - You need to change the way you think and not rely on the notion that money is going to fix your problems in your life

Spiritual fit - not religious, but know your purpose. What is the reason you get out of bed every morning?

Financially fit - once you have the first three sets, you can feel the benefits of your money, help you give more, invest more into yourself or your business etc.

Listen to this podcast if you want to start a family or have more kids

I had done bits over the years, like read the Barefoot Investor book and applied some of the knowledge, but even then, I was still lazy with how I CARED about my money mindset. It still felt like an afterthought vs being proactive or engaged in understanding where my money was being spent.

This brought me to 2023, and I intended to begin rewiring my money story completely. Even with this intention, I have learnt that it wasn’t as clear as I could have made it. This money journey so far feels like I am decluttering my wardrobe, and everything has to be taken out to organise what to keep, what to toss, and what needs to be updated. It’s a giant mess before it starts looking organised and neat when you start putting it back into the correct places. But it can be emotional because you notice things you are paying for that you should get rid of but don’t want to let go of that subscription even though you don’t need it or can afford it. See how my journey has unfolded and how I have managed to declutter most of it in one month.

Keep reading with a 7-day free trial

Subscribe to Care More With Kim to keep reading this post and get 7 days of free access to the full post archives.